X marks the spot for cold storage: Southeast U.S. population growth drives cold storage boom at JAXPORT

- Home

- >

- Cargo Blog

- >

- X marks the spot for cold storage: Southeast U.S. population growth drives cold storage boom at JAXPORT

Written by: Marcia Pledger

Providers supply food, medical supplies, and other temperature-controlled necessities to consumers throughout the region and beyond

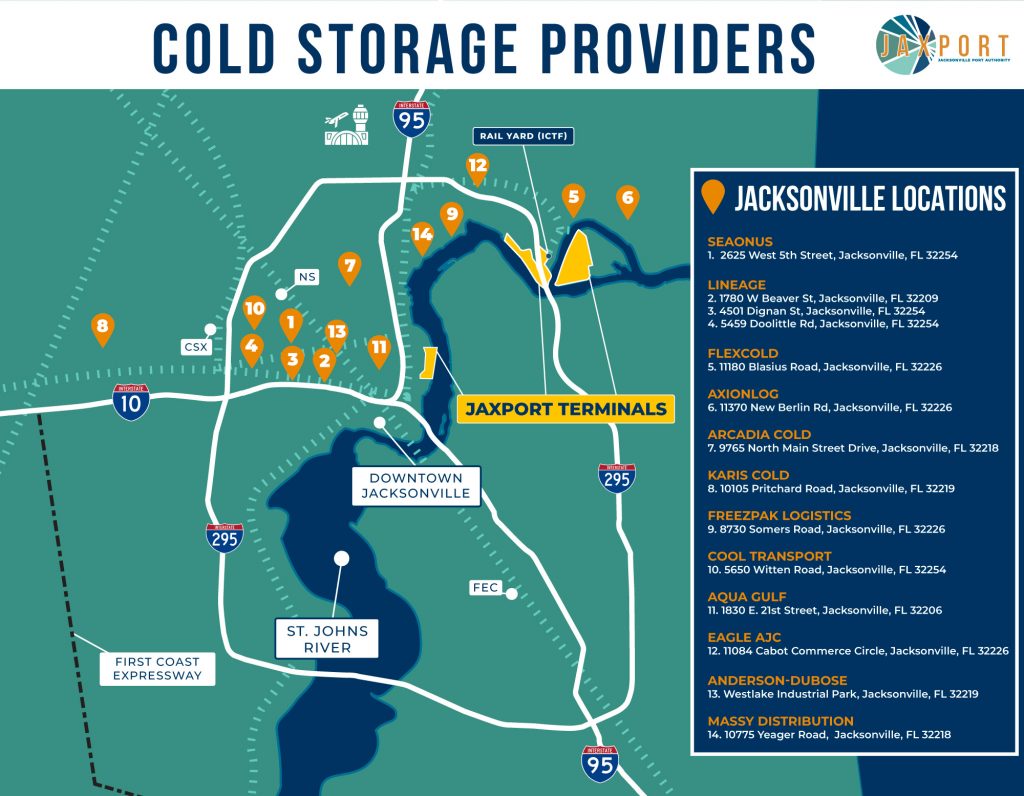

An increasing number of cold storage companies are building new facilities or expanding their current footprints in Jacksonville.

Cold storage facilities are designed for short-term temperature-controlled storage needs of food companies and distributors, and growth is expected to continue to rise in the next several years. Globally, the market is estimated at $11.8 billion, and it’s expected to reach $32.8 billion by 2030, according to global market research firm Research and Markets.

There are many reasons for Jacksonville’s cold storage success. Consumer behavior in recent years has prompted major changes in grocery shopping, online ordering, restaurant operations, pharmaceutical storage, agriculture, and food manufacturing, which has created increased demand for storage space in Northeast Florida. The area’s cold storage providers efficiently serve the Southeastern U.S. and markets abroad by utilizing Jacksonville’s deepwater seaport and strong transportation network.

Jacksonville’s port terminals have long moved food, medicine, and other cargoes that require temperature-controlled warehousing.

Cold storage provider Seaonus has operated in Jacksonville since 1987 and handles fresh and frozen poultry and pork; frozen beef and seafood; and refrigerated juices, sauces, and dairy products at its Northwest Jacksonville warehouse. The facility accompanies the Seaonus breakbulk terminal located at JAXPORT’s Talleyrand Marine Terminal.

“In the early years the cold storage space was adequate to meet the needs of the local distribution market and supported shipments to Puerto Rico,” said Seaonus Director of Sales and Customer Service Randy McMaster. “With the population growth in Northeast Florida, the cold storage space grew to support the growing grocery industry. As the population of the Southeast U.S. went up, so did the demand for cold storage.”

Lineage entered the Jacksonville market in May 2019 when it acquired Preferred Freezer Services. The company now owns three local facilities in addition to the more than 230 port-centric facilities worldwide, either at ports or within 30 miles of ports, which serve as critical components that connect their clients to global markets.

“Port-centric locations like Jacksonville are important to Lineage because they tend to offer irreplaceable locations and strong, consistent demand underpinned by a large population of consumers,” said company spokesperson Christina Wiese.

Jacksonville is a key component in Lineage’s global growth plan. The company’s local modern warehouses offer several value-added services including USDA inspections, drayage, inbound and outbound trucking, customs brokerage and on-demand managed transportation for their cold chain customers.

In 2022, cold storage providers FlexCold and Axionlog opened their North Jacksonville facilities.

FlexCold launched its first cold storage operation in Jacksonville two years ago, and now it’s doubling the size of its warehouse facility. The company expanded the operation to 350,000 square feet from 150,000 square feet and expects the expansion to be complete this month. With 55,000 pallet positions, whether it’s meat, seafood, poultry, frozen produce or seafood, the state-of-the art facility is aimed at moving food efficiently through the food chain. The company selected Jacksonville because of the significant amount of food production happening in the region.

“Our focus is the Southeast,” FlexCold Co-Founder Jeff Manno said. “A lot of the recent supply in the last few years has focused on larger markets. We see Jacksonville as a high growth market. We’re excited about where we are and where we’re heading.”

The U.S. Southeast is also a key market for cold storage provider Axionlog, whose customers include global restaurant chains and wholesale companies. Jacksonville serves as a global hub for Axionlog’s thirty-one distribution centers in thirteen countries, where cargo from around the world is consolidated at its 40,000-square-foot building and exported to Latin America.

Within months of opening the first of three phases of their Northeast Jacksonville warehouse, the company needed more space to meet market demand, and an expansion to triple the size of the facility is already underway. This expansion will not only increase the facility’s storage capacity from 3,000 to 10,000 pallet positions, but further facilitate its local drayage and over the road transportation operations.

“We all see the opportunity here in Jacksonville to be a transportation and infrastructure powerhouse,” said Axionlog Director of U.S. Operations Stephen Frankel. “We are all on that same path to get there… getting different lines in and out of JAXPORT. Because when we get that, we can draw more customers. So, we’re all singing from the same sheet of music with the same goals.”

In addition to a strong population base, Jacksonville’s capabilities as a deepwater seaport with a 47-foot shipping channel, new cranes, expanded trade lanes, and a strong transportation network attracted cold storage providers like Arcadia Cold, Karis Cold, and Freezpak, which all have facilities in the works.

Arcadia Cold plans to open a new cold storage facility in Jacksonville in the fall, making it the company’s sixth U.S. storage facility opened in the last year. The fast-growing company identified Jacksonville as a key part of its strategic plan because of its ability to reach about 100 million people in a day’s drive.

The national demand for cold storage space, the size and pace of investments and plans for growth in Jacksonville were also attractive to the company.

“We’re eager to join a port with a clear vision for growth, actively investing in itself and establishing container routes that connect with South America,” said Chris Hughes, Co-Founder and CEO of Arcadia Cold. “We also appreciate the direct container service routes, both inbound and outbound, as they align perfectly with the needs of our customers who deal in perishable goods, whether frozen or refrigerated, across U.S. import and export channels.”

JAXPORT’s capabilities impressed cold storage provider Karis Cold, a Naples-based company building a 265,000-square-foot plant in Northwest Jacksonville, with options to expand if the company adds a rail component. The facility is expected to open by early 2025 and will offer a range of temperatures to accommodate clients’ needs, from pharmaceuticals to seafood, beef, and produce.

“The port has an entrepreneurial spirit. They made it clear that they want to help,” Karis Cold CEO Jake Finley said. “They were willing to meet, collaborate and make introductions. They have a true spirit of partnership, which is refreshing.”

Finley said JAXPORT has been on the company’s radar since 2018 because of its great location right off of I-95, which helps serve the company’s Southeast division.

Jacksonville’s location in the Southeast was also a main draw for FreezPak Logistics. The company’s Sales Manager Sam Wartell said Jacksonville is part of its strategic plan because it offers quick access to multiple highways including 1-95, 1-10 and 1-75, and the opportunity to service railways through CSX.

“It’s a developing port and they’re hungry for more business. JAXPORT CEO Eric Green and his team are doing a good job at building up the port,” Wartell said. “Jacksonville has a very business friendly local government with tax incentives for companies offering employment,” he said.

As these facilities are built or expanded, the jobs and economic impact also come along with them.

“That’s all part of our mission here at JAXPORT, to serve as an economic engine for the region and state,” said JAXPORT Director, Cargo Development Rick Schiappacasse. “Their collective strength in being here draws more cold storage cargo through the area, supporting our capabilities and the economy.”

Other cold storage facilities in Northeast Florida include G & C Foods, Anderson-Dubose, Massy Distribution, U.S. Cold Storage, Cool Transport, Aqua Gulf and Eagle AJC.

Companies interested in learning about Jacksonville’s cold chain solutions can contact Rick at Ricardo.Schiappacasse@JAXPORT.com.